About H1B visa

The H1B visa enables skilled workers with specialized expertise to live in the US for three years (later it can be extended for another three years), and work for a sponsoring employer.

In order to apply, you need specialized knowledge and a bachelor’s degree or equivalent work experience in areas such as medicine, science, mathematics, information technology, architecture, finance, and accounting.

You can find more about H1B visa eligibility, application process, and visa duration here.

H1B Visa Income Tax Obligations

ProPublica revealed that TurboTax maker Intuit charged millions of Americans for tax filing services they were eligible to receive for free. Now multiple state attorneys general have opened. You can check back with the TurboTax blog and with the California Franchise Tax Board for more information. Golden State Stimulus I (GSS I) California signed the Golden State Stimulus I, which includes $600-$1200 cash payments to eligible residents. Eligibility is based on your 2020 tax return (the one you file in 2021). Claim your free state in TurboTax Exit TurboTax Go to C: ProgramData Intuit TurboTax TY19 Delete or rename 'EntitlementTTWin.xml' and 'PriceS2009US1040PER.xml' (names might be slightly different) Modify 'EntitlementTTWin.ini' so that all values = 0 Go to C: Users user AppData Roaming Intuit TurboTax TY19 Delete or rename 'TTWinUserState.xml'.

What is the tax rate for H1B visa holders?

The answer to this question depends on your income level.

If you work in the US as a H1B worker, you can expect to pay between 20-40% of your wages in federal, state and local taxes.

These taxes will include:

- Federal income tax

- Local income tax (depending on where you live)

- State income tax (depending on where you live)

- Federal Social security and Medicare tax- (FICA)

While living in the US, you may also pay property tax, sales tax, capital gains tax, transfer tax, inheritance or estate tax, hotel or lodging tax, gas tax and more.

Federal Social security and Medicare (FICA)

These taxes are pension and healthcare provisions for retirement.

6.2% of your gross salary will be deducted for social security and 1.45% for Medicare and your employer contributes the same amount.

Depending on the tax treaty the US has with your home country, in some cases, you can receive Social Security after you leave.

Learn more about FICA tax exemption for nonresidents here.

Federal Income Tax on an H1B

If you are a nonresident and working in the US on a H1B visa, you will be taxed on money that you make in the US, at the same rate as US citizens. You are obliged to file a US tax return (form 1040NR), but you can not claim the same deductions as US citizens.

If you become a US resident you will have access to those deductions, but you will also be charged on your worldwide income.

Your income level determines the tax rate, which ranges from 10% to 39.6%. The US has progressive “marginal brackets”. Most H1B visa holders pay between 20-35% of their income.

2021 Federal income tax brackets

| Tax rate | Single | Married, filing jointly | Married, filing separately | Head of household |

| 10% | $0 to $9,950 | $0 to $19,990 | $0 to $9,950 | $0 to $14,200 |

| 12% | $9,951 to $40,525 | $19,901 to $80,050 | $9,951 to $40,525 | $14,201 to $54,200 |

| 22% | $40,526 to $86,375 | $80,051 to $172,750 | $40,526 to $86,375 | $54,201 to $86,350 |

| 24% | $86,375 to $164,925 | $172,751 to $329,850 | $86,376 to $164,925 | $86,351 to $164,900 |

| 32% | $164,425 to $209,425 | $329,851 to $418,850 | $164,926 to $209,425 | $164,901 to $209,400 |

| 35% | $209,426 to $523,600 | $418,851 to $628,300 | $209,426 to $314,150 | $209,401 to $523,600 |

| 37% | $5123,601 or more | $628,301 or more | $314,151 or more | $523,601 or more |

Local income tax

Some cities have a local income tax, which varies between 1-4% of your gross income. This tax will be withheld by your employer and it’s very important that your address on your W4 is correct, otherwise, you may end up paying incorrect local tax.

During the tax season, you may need to file a local income tax return (where applicable), and Sprintax can assist you!

If you have any tax-related questions you can always get in touch with our 24/7 Live Chat support.

State income tax

How much you will pay depends entirely on the state that you work in. The tax will be withheld by your employer. This tax usually ranges from 0 to 10% of your gross income. The same applies to both citizens and non-citizens. Some states do not have a personal income tax, these are- Wyoming, Washington, Alaska, Florida, South Dakota, Texas and Nevada. What’s more Tennessee and New Hampshire only tax interests and dividends at the state level.

From January to April (during the tax season) you will need to file a state income tax return. You can also file an extension and change the due date to October instead.

I live in one state and work in another. How does this affect my taxes?

In such a situation, you may need to file tax returns in both states and you will usually pay the higher of the two states taxes.

The good news is that Sprintax can help you with your multi-state tax returns. If you have questions, you can always get in touch with our 24/7 Live Chat support.

Filing taxes on H1B

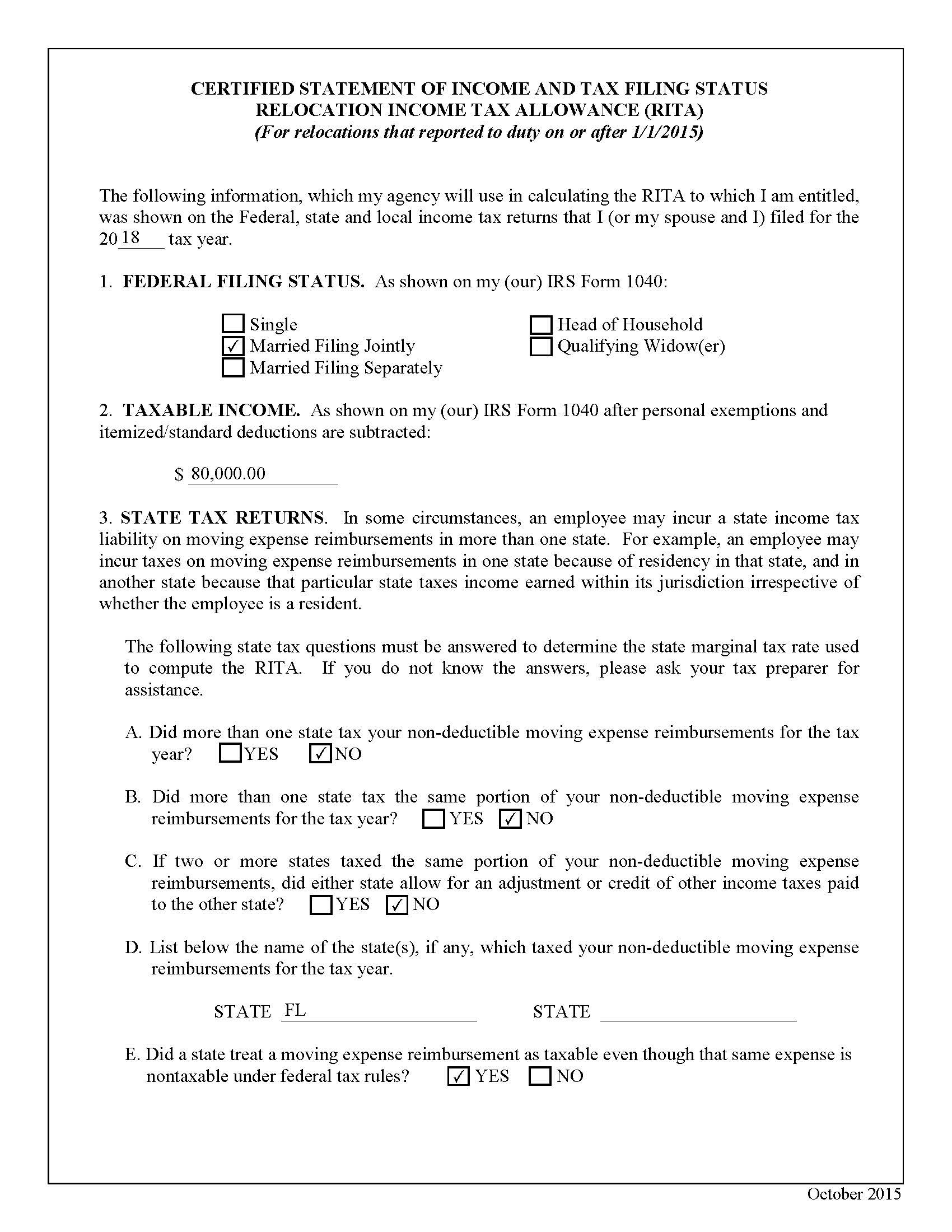

Determine your residency status with the substantial presence test

There are two types of aliens for tax purposes- resident and nonresident aliens. In order to file your taxes, you must determine your residency status with the substantial presence test and Sprintax can do this for you. The test is applied on a calendar year-by-calendar year basis.

Resident aliens are taxed in the same way as US citizens on their worldwide income, while nonresident aliens are taxed only on income from US sources.

Gather your tax documentation

You will need your Social Security Card and all tax forms like W-2, forms 1099 series, investment income statement and other income information.

If you are a resident of Canada, Mexico, South Korea or student or business apprentice from India, you may be entitled to claim some additional credits due to US residents only like child credits. If you want to claim any of the residents’ tax deductions you must back up your claims with receipts for child care, educational cost and other applicable receipts.

How to file your taxes

When you are ready with all the required documents you can proceed with filing your tax return.

If you are a temporary visitor to the US on a H1B working visa you can file your taxes directly yourself. Alternatively, if you’d like some help with all that tricky paperwork, Sprintax can prepare your income tax return for you!

Can I file jointly with my spouse?

If you were married during the tax year, you do not have the option to file a return jointly with your spouse if you both are nonresident aliens, and married nonresident alien status is also treated as a single.

This means that your spouse has the same filing obligations that you’ll have.

Can I claim dependents on my tax return?

Nonresidents are not allowed to claim dependents on their tax return. However, residents of Canada, Mexico, South Korea and some business apprentices or students from India may claim child tax credits for their family members if certain conditions are met.

If you want to claim a dependent, you must file using Form 1040 NR, because the exemption cannot be taken on Form 1040NR-EZ.

For additional information on tax exemptions & deductions for family members, please take a look here.

Who can help me with my H1B tax preparation?

If you are a nonresident alien on a H1B visa in the US, Sprintax can help you to e-file your federal tax return and prepare your state tax return.

Simply, create your account and in a few minutes, you will be ready to complete your tax returns!

With Sprintax you can:

- easily e-file your federal tax return and prepare your state return, because Sprintax is the only online software for nonresidents

- chat with qualified agents 24/7

- get the maximum tax refund and avail of every tax entitlement

Taxes can be fun!

Maximum Refund Guarantee – or your hard earned money right straight straight Back: in the event that you have a bigger reimbursement or smaller tax due from another income tax planning technique, we are going to refund the TurboTax that is applicable federal state price compensated. TurboTax on line complimentary Edition clients have entitlement to re payment of $30.

100% Accurate Expert Approved Guarantee: you the penalty and interest if you pay an IRS or state penalty (or interest) because of an error that a tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we’ll pay.

Audit Support Guarantee: we will provide one-on-one support with a tax professional as requested through our Audit Support Center for returns filed with TurboTax for the current tax year (2020) and the past two tax years (2019, 2018) if you received an audit letter based on your 2020 TurboTax return,. Whenever we aren’t able to link one to certainly one of our taxation specialists, we’re going to refund the relevant TurboTax federal and/or state price compensated. TurboTax complimentary Edition clients have entitlement to re re payment of $30. We’ll maybe perhaps not represent you or offer legal counsel. Excludes TurboTax company.

TURBOTAX ONLINE/MOBILE

Try for Free/Pay whenever You File: TurboTax on the web and mobile rates is predicated on your taxation situation and differs by item. TurboTax Free Edition ($0 Federal + $0 State + $0 To File) can be obtained for easy tax returns just; offer may alter or end at any time without warning. Real costs are determined during the time of print or e-file and therefore are susceptible to alter with no warning. Special discount provides may possibly not be legitimate for mobile purchases that are in-app.

TurboTax Live Basic provide: provide only available with TurboTax Live fundamental as well as for easy taxation statements just. Must register by March 27, 2021 to qualify for the offer. Includes state(s) plus one (1) federal tax filing. Intuit reserves the proper to change or end this TurboTax Live Basic provide at any moment for just about any explanation in its single and discretion that is absolute. In the event that you add solutions, your solution charges should be modified correctly. If filed after March 27, 2021, you’ll be charged the then-current list cost for TurboTax Live fundamental and state taxation filing is definitely a extra charge. See present rates here.

will pay for itself (TurboTax Self-Employed): quotes according to deductible company costs determined in the self-employment taxation earnings rate (15.3%) for income tax 12 months 2020. Real outcomes will be different centered on your income tax situation.

when, anywhere: online access needed; standard data prices apply to download https://paydayloanservice.net/installment-loans-hi/ and make use of mobile software.

Fastest reimbursement feasible: Quickest taxation refund with e-file and deposit that is direct taxation reimbursement time frames will be different. The IRS dilemmas a lot more than 9 away from 10 refunds in less than 21 times.

purchase TurboTax out of your refund that is federal $40 reimbursement Processing Service cost pertains to this re re payment technique. Costs are susceptible to alter without warning.

TurboTax support and help: use of a TurboTax expert is roofed with TurboTax Deluxe, Premier, Self-Employed, TurboTax Live, and TurboTax Live Full provider; perhaps perhaps maybe not added to complimentary Edition (but is available being a update). TurboTax experts can be found to produce basic consumer assistance and help utilising the TurboTax item. SmartLook on-screen assistance can be acquired for a computer, laptop or even the TurboTax mobile application. Provider, section of expertise, experience levels, wait times, hours of procedure and access differ, and are also at the mercy of limitation and alter without warning.

File State Taxes Free

Tax information, Professional Review and TurboTax Live: Access to tax advice and Expert Review (the capability to have a Tax Expert review and/or sign your taxation return) is roofed with TurboTax Live or as an update from another variation, and available through 31, 2021 december. These types of services are given just by taxation specialists or CPAs. Some income tax topics or circumstances is almost certainly not included as an element of this solution, which will probably be determined within the tax expert’s sole discretion. For TurboTax Live , if the return calls for a substantial degree of taxation advice or actual planning, the taxation specialist can be expected to signal because the preparer from which point they’ll assume primary obligation when it comes to planning of one’s return. The tax expert will sign your return as preparer for the Full Service product. On-screen assistance is present for a desktop, laptop computer or the TurboTax app that is mobile. Limitless use of taxation professionals or CPAs relates to a quantity that is unlimited of accessible to each consumer, but doesn’t relate to hours of procedure or solution protection. Provider, section of expertise, experience levels, wait times, hours of availability and operation differ, and are also at the mercy of limitation and alter with no warning.